Sport analytics leverage AI and ML to improve the game

CIO Business Intelligence

APRIL 8, 2024

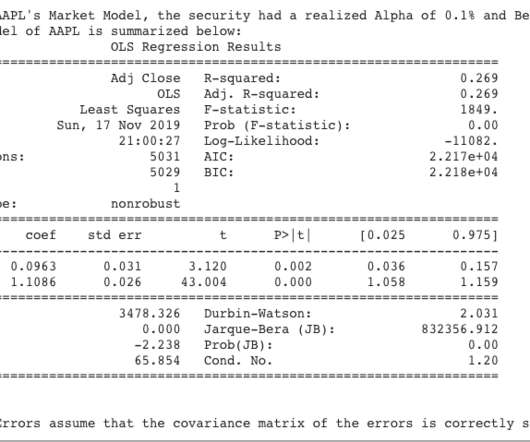

In the years since author Michael Lewis popularized sabermetrics in his 2003 book, Moneyball: The Art of Winning an Unfair Game , sports analytics has evolved considerably beyond baseball. Risk Mitigation Modeling can then be used to analyze training data and determine a player’s ideal training volume while minimizing injury risk.

Let's personalize your content