Managing machine learning in the enterprise: Lessons from banking and health care

O'Reilly on Data

JULY 15, 2019

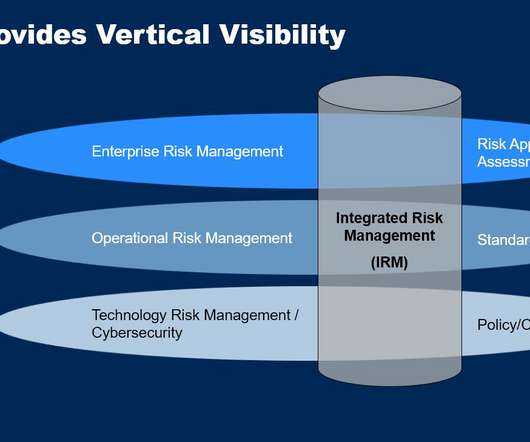

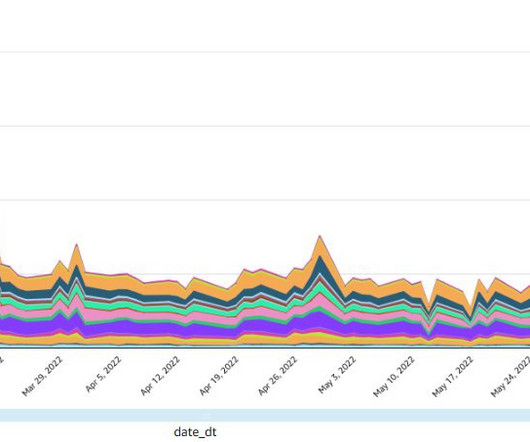

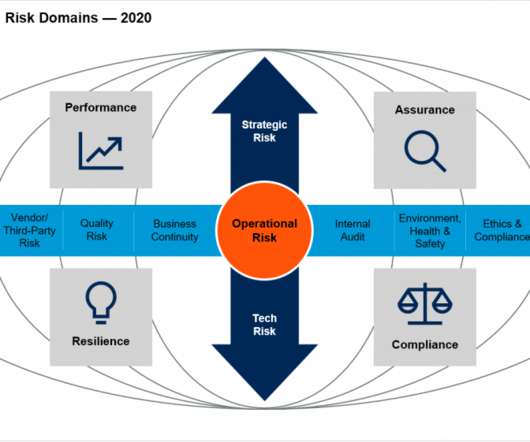

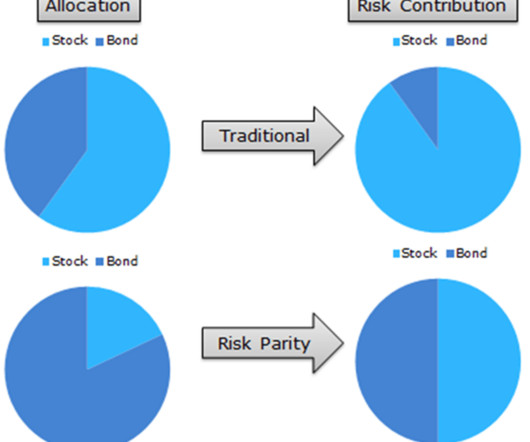

After the 2008 financial crisis, the Federal Reserve issued a new set of guidelines governing models— SR 11-7 : Guidance on Model Risk Management. Note that the emphasis of SR 11-7 is on risk management.). Sources of model risk. Model risk management. Image by Ben Lorica. model re-training).

Let's personalize your content