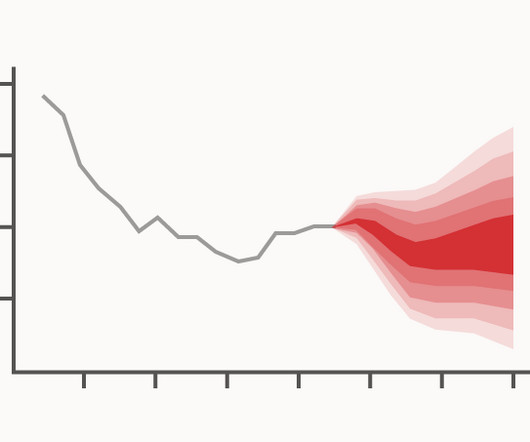

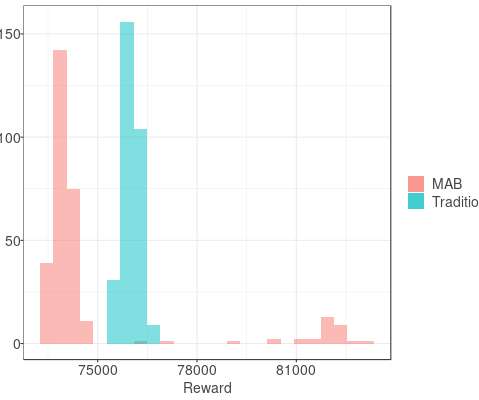

Chart Snapshot: Fan Charts

The Data Visualisation Catalogue

OCTOBER 18, 2024

A Fan Chart is a visualisation tool used in time series analysis to display forecasts and associated uncertainties. Each shaded area shows the range of possible future outcomes and represents different levels of uncertainty with the darker shades indicating higher levels of probability.

Let's personalize your content