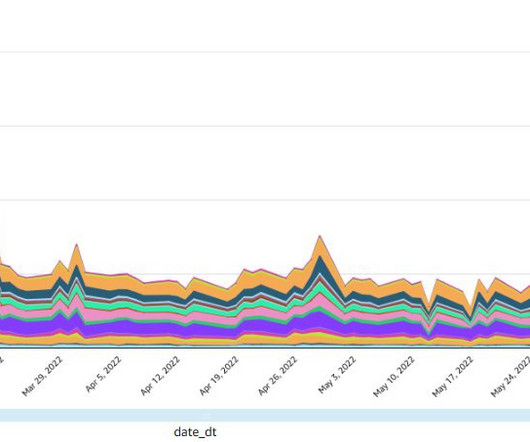

Why you should care about debugging machine learning models

O'Reilly on Data

DECEMBER 12, 2019

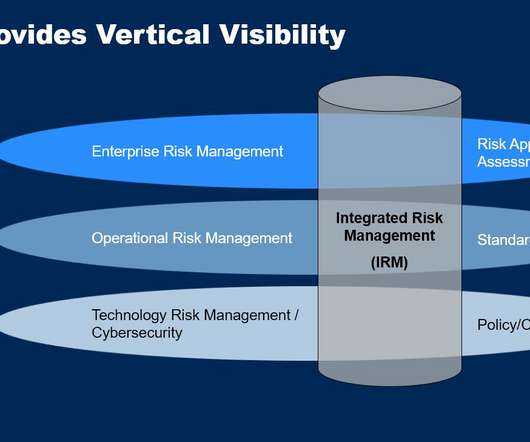

In addition to newer innovations, the practice borrows from model risk management, traditional model diagnostics, and software testing. While our analysis of each method may appear technical, we believe that understanding the tools available, and how to use them, is critical for all risk management teams.

Let's personalize your content