A “PRACtical” View of Emerging Risk Management Technologies

John Wheeler

AUGUST 19, 2019

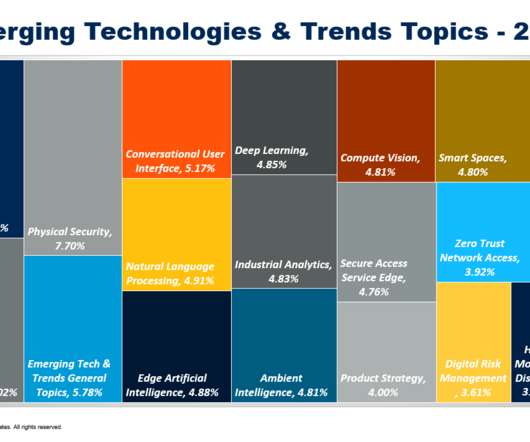

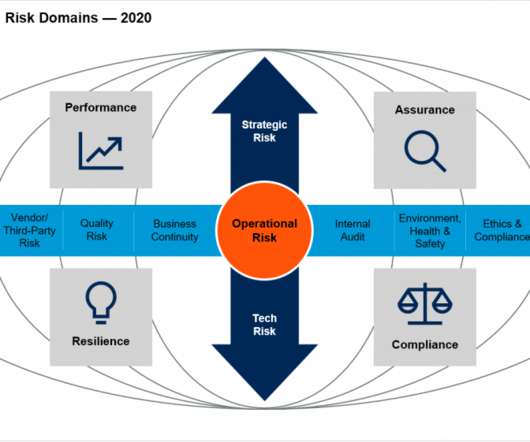

Gartner’s “Hype Cycle for Risk Management, 2019” report was published almost a month ago and reader response has been overwhelmingly positive. In this year’s report, we highlight the need for a “PRACtical” view of risk management technologies to fuel digital business growth.

Let's personalize your content