More Than Two-Thirds of IT and Finance Professionals Waste a Day Each Week on Operational Reports, According to New insightsoftware Research

Jet Global

APRIL 12, 2023

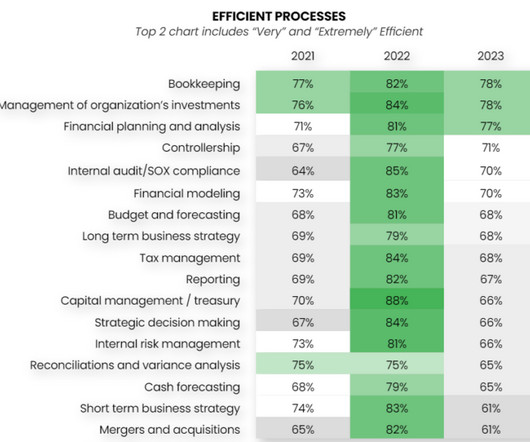

. – April 12, 2023 – insightsoftware , a global provider of reporting, analytics, and performance management solutions, today released new research on the state of operational reporting. Key findings include: Operational reporting costs 71% of IT departments, on average, 1 day per week, or $23,730 per year in salary costs.

Let's personalize your content