2025 Middle East tech trends: How CIOs will drive innovation with AI

CIO Business Intelligence

DECEMBER 30, 2024

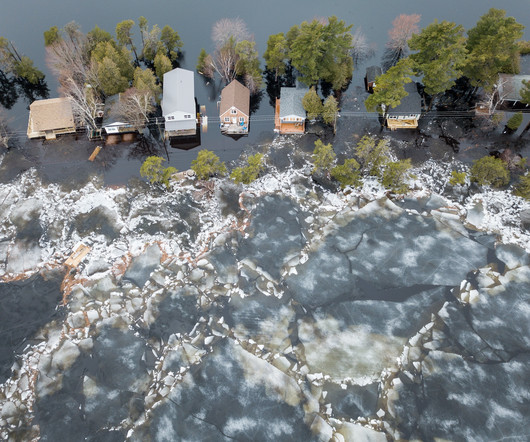

The energy sector, driven by sustainability goals such as Saudi Arabias Vision 2030 and the UAEs Net Zero 2050, will see a surge in investments in smart grids, renewable energy, and AI-powered energy efficiency solutions. As digital transformation accelerates, so do the risks associated with cybersecurity.

Let's personalize your content