How Macmillan Publishers authored success using IBM Cognos Analytics

IBM Big Data Hub

AUGUST 28, 2023

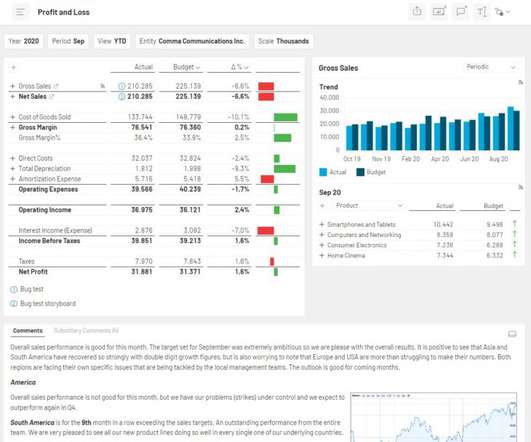

For more than 10 years, the publisher has used IBM Cognos Analytics to wrangle its internal and external operational reporting needs. This encompasses their finance, sales, supply chain, inventory management and production areas.

Let's personalize your content