Global SMEs Adopt New Business Intelligence Initiatives During COVID-19 Crisis

Smart Data Collective

NOVEMBER 24, 2020

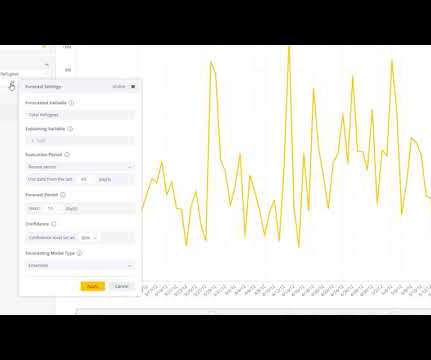

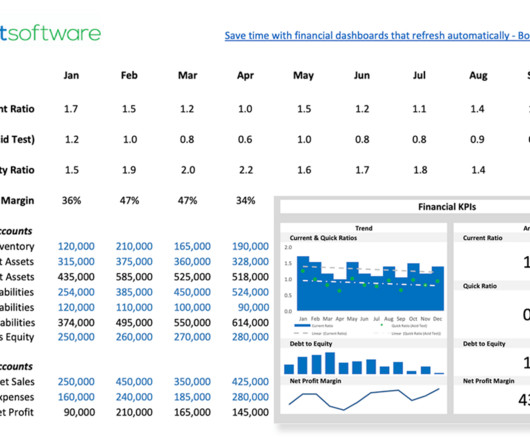

Of course, these solutions use new data-driven insights to help you to keep track of tasks, manage reporting, reduce storage and security costs. Using these analytics tools, you can easily manage inventory, forecast sales, calculate taxes, and monitor order fulfillment. eCommerce Business Intelligence Software.

Let's personalize your content