Middle East tech leaders explore AI’s role in modern risk management

CIO Business Intelligence

NOVEMBER 11, 2024

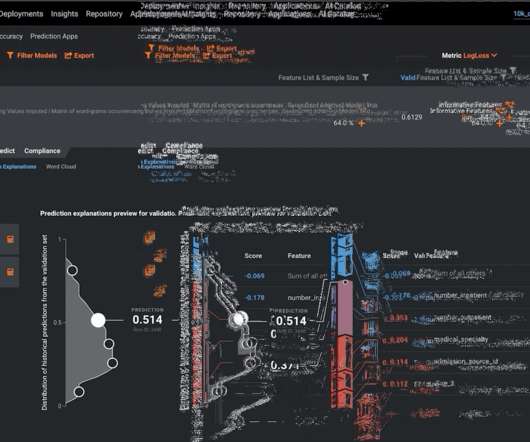

In today’s fast-paced digital environment, enterprises increasingly leverage AI and analytics to strengthen their risk management strategies. By adopting AI-driven approaches, businesses can better anticipate potential threats, make data-informed decisions, and bolster the security of their assets and operations.

Let's personalize your content