Get Creative with AI Forecasting in Changing Economic Conditions

DataRobot Blog

OCTOBER 4, 2022

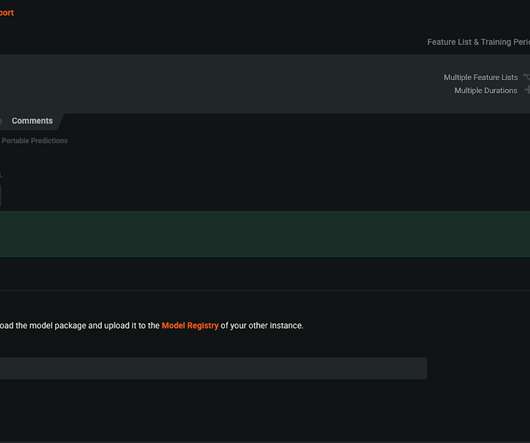

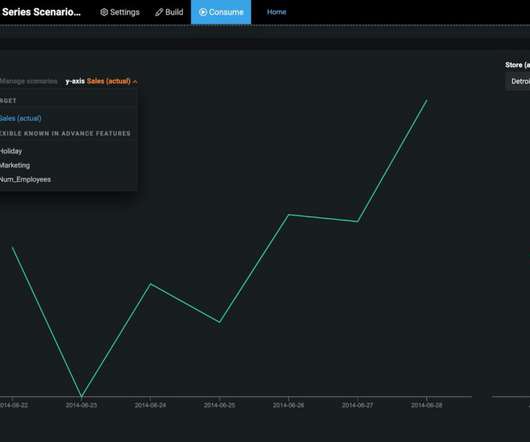

This has prompted AI/ML model owners to retrain their legacy models using data from the post-COVID era, while adapting to continually fluctuating market trends and thinking creatively about forecasting. In the last few years, businesses have experienced disruptions and uncertainty on an unprecedented scale. The Dataset.

Let's personalize your content