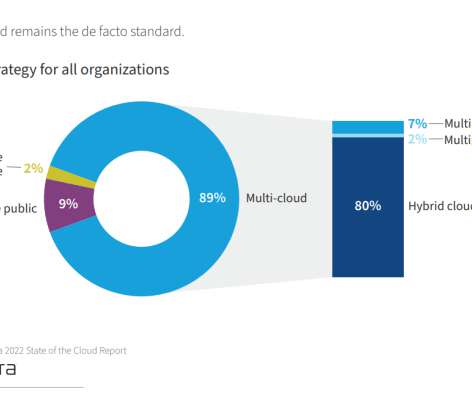

12 Cloud Computing Risks & Challenges Businesses Are Facing In These Days

datapine

MAY 31, 2022

Exclusive Bonus Content: Download our free cloud computing tips! This increases the risks that can arise during the implementation or management process. The risks of cloud computing have become a reality for every organization, be it small or large. The next part of our cloud computing risks list involves costs.

Let's personalize your content