insightsoftware Launches Angles Professional for Oracle to Automate Recurring Operational Reports at the Gartner Data & Analytics Summit 2023

Jet Global

MARCH 20, 2023

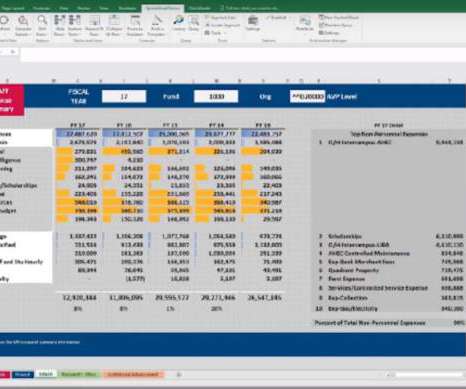

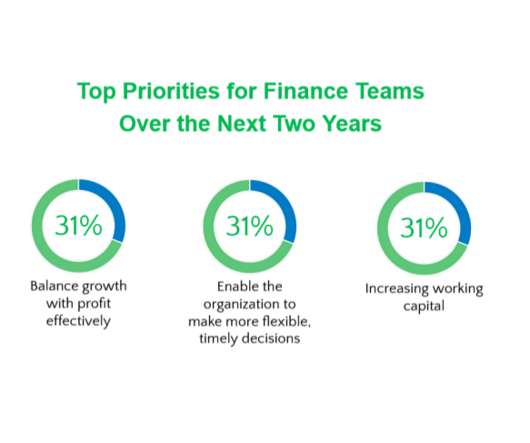

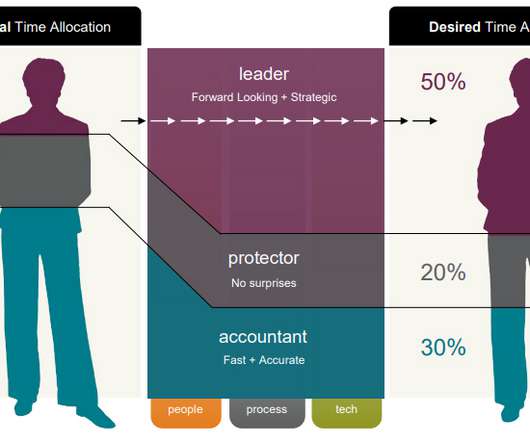

This data is gleaned from a report from insightsoftware and Hanover Research: The Operational Reporting Global Trends Report. The migration to cloud ERPs is increasing, but the need for better operational reporting remains.

Let's personalize your content