Changing assignment weights with time-based confounders

The Unofficial Google Data Science Blog

JULY 22, 2020

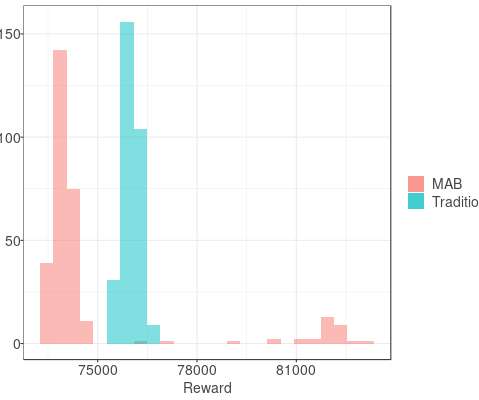

For the first example, consider a small website that is a platform for content on personal finance. How willing your users are to engage with personal finance content depends on whether or not it’s the weekend. For this reason we don’t report uncertainty measures or statistical significance in the results of the simulation.

Let's personalize your content