Moving From Spreadsheets to Dataiku for Financial Modeling

Dataiku

SEPTEMBER 8, 2021

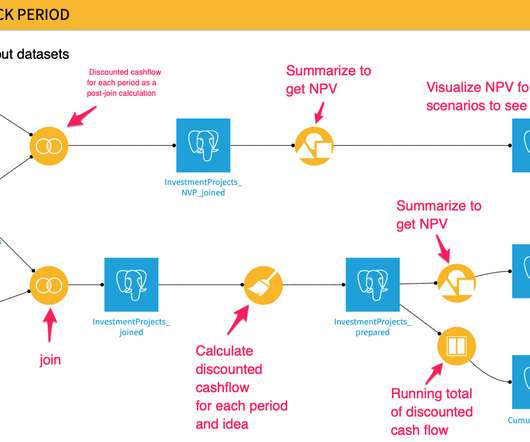

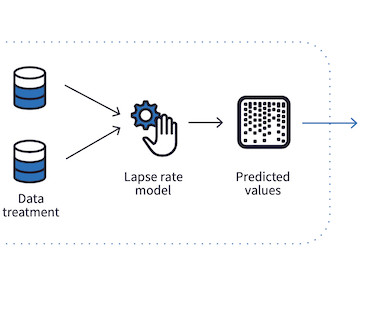

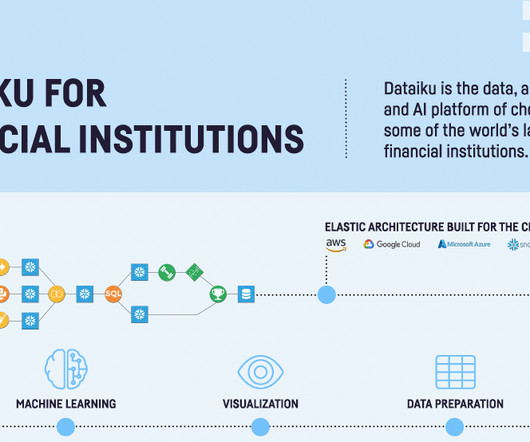

This article presents how financial modeling can be done inside Dataiku. Let’s begin with the context: spreadsheet-based tools like Microsoft Excel are some of the most popular tools for financial modeling and are used for all kinds of tasks including investment analysis, P&L modeling, and risk management.

Let's personalize your content