Building Tax Planning into Enterprise Risk Management Strategies

Jet Global

MARCH 30, 2021

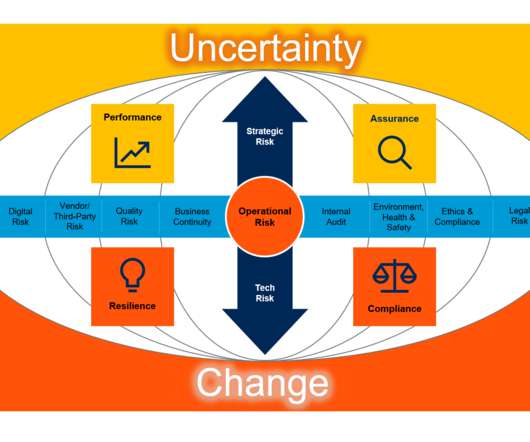

Tax planning is playing an increasingly important part in corporates’ enterprise resource management (ERM) strategies, driven by the many uncertainties created by political, economic, and pandemic-related trends. Reputational management is another driver for boards to build tax planning into ERM strategies.

Let's personalize your content