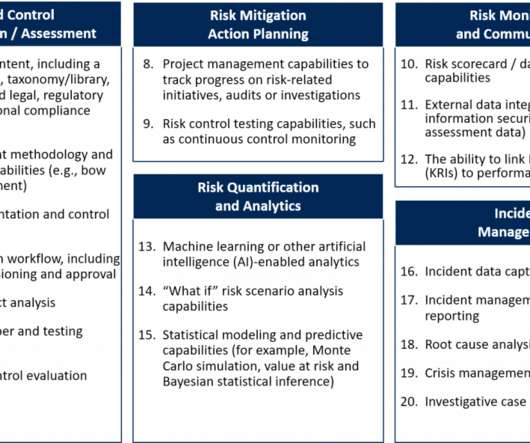

Proposals for model vulnerability and security

O'Reilly on Data

MARCH 20, 2019

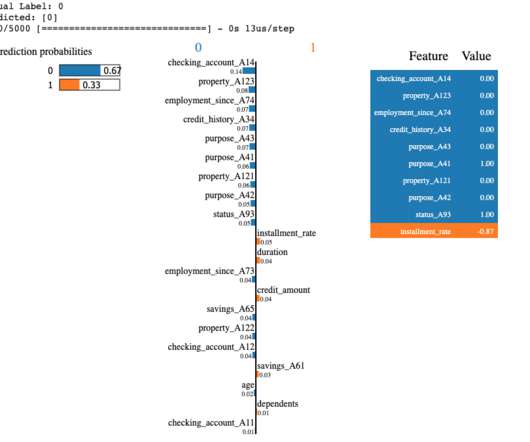

Apply fair and private models, white-hat and forensic model debugging, and common sense to protect machine learning models from malicious actors. Like many others, I’ve known for some time that machine learning models themselves could pose security risks. they can train their own surrogate model.

Let's personalize your content