Solving the Insurance Industry’s Data Quality Problem

Corinium

FEBRUARY 3, 2020

Unfortunately for the insurance industry’s data leaders, many data sources are riddled with inaccuracies. Data is the lifeblood of the insurance industry.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Corinium

FEBRUARY 3, 2020

Unfortunately for the insurance industry’s data leaders, many data sources are riddled with inaccuracies. Data is the lifeblood of the insurance industry.

DataKitchen

JUNE 27, 2022

Chris Bergh shares how to manage data quality and pipeline risk through implementing a 'Mission Control' center for DataOps. The post DataOps Risk Insurance & Mission Control first appeared on DataKitchen.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Agent Tooling: Connecting AI to Your Tools, Systems & Data

Automation, Evolved: Your New Playbook for Smarter Knowledge Work

Data Talks, CFOs Listen: Why Analytics Are Key To Better Spend Management

Mastering Apache Airflow® 3.0: What’s New (and What’s Next) for Data Orchestration

Smart Data Collective

MARCH 27, 2020

The auto insurance industry has always relied on data analysis to inform their policies and determine individual rates. The good news is that this new data can help lower your insurance rate. Here is the type of data insurance companies use to measure a client’s potential risk and determine rates. Demographics.

CIO Business Intelligence

DECEMBER 5, 2024

Why data distilleries are a game-changer: Insights from the insurance industry Traditionally, managing data in sectors like insurance relied on fragmented systems and manual processes. Historically, insurers struggled with fragmented data sources, leading to inefficient data aggregation and analysis.

CIO Business Intelligence

NOVEMBER 1, 2024

One of the world’s largest risk advisors and insurance brokers launched a digital transformation five years ago to better enable its clients to navigate the political, social, and economic waves rising in the digital information age.

Smart Data Collective

DECEMBER 21, 2020

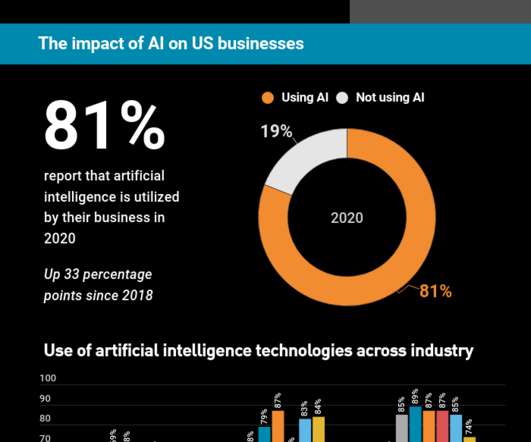

We previously talked about the benefits of data analytics in the insurance industry. billion from the insurance industry. However, major advances in AI have arguably affected the insurance industry even more. The insurance industry is evolving with new changes in AI. How is AI changing the future of insurance claims?

TDAN

NOVEMBER 6, 2024

Climate change is no longer a distant threat, but a present reality that’s reshaping the insurance landscape across the United States. home insurance market is far more severe and widespread than previously thought, potentially affecting every homeowner in the […]

CIO Business Intelligence

NOVEMBER 1, 2024

One of the world’s largest risk advisors and insurance brokers launched a digital transformation five years ago to better enable its clients to navigate the political, social, and economic waves rising in the digital information age.

Smart Data Collective

NOVEMBER 10, 2021

Big data technology has been a huge gamechanger in the insurance sector. More insurance are using big data to assist with the underwriting process. They are getting a better understanding of risk and choosing rates for their policyholders. However, insurance companies aren’t the only ones affected by big data.

datapine

MAY 31, 2022

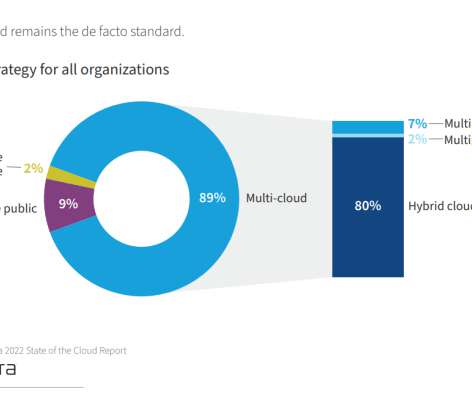

This increases the risks that can arise during the implementation or management process. The risks of cloud computing have become a reality for every organization, be it small or large. The next part of our cloud computing risks list involves costs. One of the risks of cloud computing is facing today is compliance.

Corinium

NOVEMBER 18, 2019

Disasters drive innovation in the insurance industry.

Smart Data Collective

JUNE 3, 2021

The insurance industry is among those that has found new opportunities to take advantage of machine learning technology. Life insurance companies in particular are discovering the wondrous opportunities that AI provides, since this sector faces some unique challenges relative to other insurance offerings.

CIO Business Intelligence

OCTOBER 16, 2024

>To help insurance brokerages tie in disparate systems to manage their operations and increase employee productivity, CRM software provider Salesforce has introduced a new offering in preview, the Financial Services Cloud. In addition, Financial Services Cloud can be used to service property and casualty insurance clients as well.

O'Reilly on Data

JANUARY 15, 2020

Should insurance policies be personalized in a webpage using reinforcement learning, and what are the attributes that should drive that? Or is an algorithm trying to find out better ways that are not goaled toward the purpose of insurance, which is a long-term financial pool of risk and social safety net.

CIO Business Intelligence

NOVEMBER 27, 2024

Unfortunately, implementing AI at scale is not without significant risks; whether it’s breaking down entrenched data siloes or ensuring data usage complies with evolving regulatory requirements. The platform also offers a deeply integrated set of security and governance technologies, ensuring comprehensive data management and reducing risk.

CIO Business Intelligence

OCTOBER 30, 2024

Whether it’s a financial services firm looking to build a personalized virtual assistant or an insurance company in need of ML models capable of identifying potential fraud, artificial intelligence (AI) is primed to transform nearly every industry.

Cloudera

NOVEMBER 4, 2020

Insurance is no different. Insurance is not something the average consumer thinks about every day but when a life changing event happens, insurance becomes extremely important. It is in this “Moment of Truth” that insurers excel or fail. To provide the best price, the insurer needs to better understand their customer.

CIO Business Intelligence

DECEMBER 19, 2024

The insurance company decided to migrate from on-premises BMC Remedy to cloud-based BMC Helix ITSM and Discovery. The insurance company decided to migrate from on-premises BMC Remedy to cloud-based BMC Helix ITSM and Discovery.

CIO Business Intelligence

NOVEMBER 11, 2024

For the global risk advisor and insurance broker that includes use cases for drafting emails and documents, coding, translation, and client research. CIOs need to be aware of the changing tides in this space and meter investment to align with the risk tolerance of their company,” Melby says. “It

CIO Business Intelligence

AUGUST 21, 2024

Adding smarter AI also adds risk, of course. “At The big risk is you take the humans out of the loop when you let these into the wild.” When it comes to security, though, agentic AI is a double-edged sword with too many risks to count, he says. “We That means the projects are evaluated for the amount of risk they involve.

CIO Business Intelligence

APRIL 23, 2024

As CIO, you’re in the risk business. Or rather, every part of your responsibilities entails risk, whether you’re paying attention to it or not. There are, for example, those in leadership roles who, while promoting the value of risk-taking, also insist on “holding people accountable.” You can’t lose.

AWS Big Data

JULY 16, 2024

This post is written in collaboration with Clarisa Tavolieri, Austin Rappeport and Samantha Gignac from Zurich Insurance Group. Zurich Insurance Group (Zurich) is a leading multi-line insurer providing property, casualty, and life insurance solutions globally.

CIO Business Intelligence

JULY 18, 2024

Mainframe security is critical to IT infrastructure, especially in industries like banking, insurance, healthcare, and government, where mainframes often store vast amounts of sensitive data. What steps can be taken to minimize the risk of hackers penetrating the mainframe? Mainframes are under more pressure than ever before.

Corinium

JUNE 6, 2019

I am the Chief Practice Officer for Insurance, Healthcare, and Hi-Tech verticals at Fractal. The Insurance practice is currently engaged with several top 10 P&C insurers in the US, across the Insurance value chain through AI, Engineering, Design & Behavioural Sciences programs.

CIO Business Intelligence

FEBRUARY 20, 2024

Sensitive personal and medical information can be used in multiple ways, from identity theft and insurance fraud to ransomware attacks. The risks and opportunities of AI AI is opening a new front in this cyberwar. It’s little wonder that data theft is increasingly common in the healthcare sector.

Cloudera

OCTOBER 28, 2021

I’ve had the pleasure to participate in a few Commercial Lines insurance industry events recently and as a prior Commercial Lines insurer myself, I am thrilled with the progress the industry is making using data and analytics. Another historic example is crop and livestock insurance in Germany in the 1700s.

CIO Business Intelligence

SEPTEMBER 9, 2024

As IT landscapes and software delivery processes evolve, the risk of inadvertently creating new vulnerabilities increases. These risks are particularly critical for financial services institutions, which are now under greater scrutiny with the Digital Operational Resilience Act ( DORA ).

Cloudera

JULY 15, 2021

We recently hosted a roundtable focused on o ptimizing risk and exposure management with data insights. For financial institutions and insurers, risk and exposure management has always been a fundamental tenet of the business. Now, risk management has become exponentially complicated in multiple dimensions. .

IBM Big Data Hub

DECEMBER 1, 2023

Insurers struggle to manage profitability while trying to grow their businesses and retain clients. Large, well-established insurance companies have a reputation of being very conservative in their decision making, and they have been slow to adopt new technologies.

CIO Business Intelligence

JANUARY 21, 2025

For example, attackers recently used AI to pose as representatives of an insurance company. Theres also the risk of over-reliance on the new systems. The key with AI will be striking the right balanceleveraging its strengths while mitigating the risks and limitations. While AI is undoubtedly powerful, its not infallible.

CIO Business Intelligence

AUGUST 20, 2024

A constellation of AIs AI-as-a-service may be another model for SMBs, says Matthew Marolda, chief innovation officer at Acrisure, a large insurance broker and financial services company. One of Acrisure’s goals with its AI initiatives is to help its small-business customers find matches for their insurance needs, he says.

IBM Big Data Hub

MARCH 25, 2024

According to Berenberg analysts , individual insurance companies faced total claims estimates of up to approximately USD 300 million. For other financial services firms outside of the insurance sector, property accepted as loan security might face climate-related risks as well. As a result, their market would shrink.

CIO Business Intelligence

MARCH 19, 2025

In October, Microsoft announced that 100,000 organizations including Standard Bank, Thomson Reuters, Virgin Money, and Zurich Insurance are using Copilot Studio, double the number just months earlier. There are risks around hallucinations and bias, says Arnab Chakraborty, chief responsible AI officer at Accenture.

Domino Data Lab

JULY 14, 2022

So the spotlight is on model risk management (MRM) and governance (MRG), two related critical processes for financial services and insurance companies, and the importance of these two disciplines is only expected to grow.

CIO Business Intelligence

JANUARY 21, 2025

CIOs feeling the pressure will likely seek more pragmatic AI applications, platform simplifications, and risk management practices that have short-term benefits while becoming force multipliers to longer-term financial returns. CIOs should consider placing these five AI bets in 2025.

CIO Business Intelligence

MARCH 16, 2022

Insurance companies are no longer only there for their customers in times of disaster. Modern approaches to insurance and changes in customer expectations mean that the insurance business model looks very different than it used to. For many insurers, this means investing in cloud.

DataRobot Blog

APRIL 29, 2022

This provides a great amount of benefit, but it also exposes institutions to greater risk and consequent exposure to operational losses. The stakes in managing model risk are at an all-time high, but luckily automated machine learning provides an effective way to reduce these risks.

CIO Business Intelligence

JANUARY 5, 2025

Research from Gartner, for example, shows that approximately 30% of generative AI (GenAI) will not make it past the proof-of-concept phase by the end of 2025, due to factors including poor data quality, inadequate risk controls, and escalating costs. [1] AI in action The benefits of this approach are clear to see.

IBM Big Data Hub

MAY 1, 2023

In this first of two posts, I investigate the anatomy of artificial intelligence and its impact on insurance. Artificial intelligence applied to insurance The insurance industry has always made extensive use of data and algorithms, such as in the calculation of insurance premiums.

O'Reilly on Data

JANUARY 28, 2019

Almost everyone who reads this article has consented to some kind of medical procedure; did any of us have a real understanding of what the procedure was and what the risks were? The outcome might not be what you want, but you've agreed to take the risk. But what about the insurance companies? Which data flows should be allowed?

CIO Business Intelligence

OCTOBER 13, 2022

Knowing your risk level as you navigate a large venue can help you avoid crowds and stay safely within your bubble – all of which empowers you to enjoy the experience all the more. Live at Eurovision: a Bluetooth App to Navigate Covid Risk. A New Normal: Bubble-Up for Safety at Live Events with Flockey. So, how does it work?

Rocket-Powered Data Science

OCTOBER 16, 2020

senior executives across eight industries: agriculture, banking, exhibitions, government, healthcare, insurance, legal, and science/medical. The sectors with the greatest increases in investment were insurance, banking, and agriculture, followed closely by healthcare and science/medical.

Cloudera

SEPTEMBER 7, 2023

With AI, financial institutions and insurance companies now have the ability to automate or augment complex decision-making processes, deliver highly personalized client experiences, create individualized customer education materials, and match the appropriate financial and investment products to each customer’s needs.

CIO Business Intelligence

JULY 26, 2024

As eye-popping estimates emerge for the cost to enterprises of dealing with aftermath of last week’s CrowdStrike-induced outages, it’s crucial to break down the sources of these expenses and understand how much of the financial burden will be absorbed by cyber insurance. billion to $1.08

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content